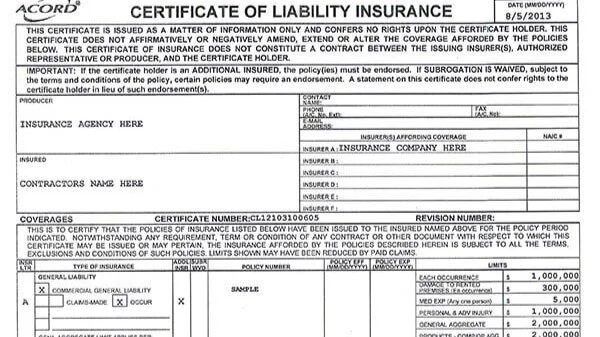

How to Read a Certificate of Insurance (Part I - General Liability)

You have your insurance all together; you purchased a policy, maybe multiple lines including General Liability, Workers Compensation, Commercial Auto, etc. But how do you decipher your Certificate of Insurance (COI)? In Part 1 of this article we will take a look at some of the main components to help you understand your General Liability and how it’s represented on a Certificate of Insurance.

DATE:

This is the date your certificate is produced on by your broker/agent. This date reflects that your policies were verified on said date and as of that date the policies were current.

PRODUCER:

This shows who your broker/agent is, more importantly it shows you where to contact them if you were to need information on your policy or if you needed to make any changes to your policy. Always good to know!

INSURED:

This should be where your company’s name and address is reflected. If you make changes to your company name or address make sure you contact your broker/agent to update and reflect the new name or address as soon as you make the changes.

INSURER(S):

Simply put this is where the insurance company (carrier) who is providing coverage for each of your policies is reflected. The insurer is the company who is insuring you, and would be affording coverage if there was a claim. The key is to understand how the letters (Insurer A) correspond with each line listed below represented on the far left of the certificate.

GENERAL LIABILITY: A couple key items to understand here!

A) There are two check boxes for “CLAIMS-MADE” and “OCCUR”

“Claims-made” means that claims have to be reported during the policy period. This means that if a claim is made after the policy has expired the claim would not be covered by your policy. These policies can be more cost efficient, but carry that caveat.

“Occur” or Full Occurrence means the claim can be reported during or after your policy term. These policies can be a bit more pricey, but great as sometimes claims are not reported until the policy has expired. Many companies will require a Full Occurrence policy, especially in industries such as construction, where claims might not always be reported during the policy term but rather after.

B) GEN'L AGGREGATE LIMIT APPLIES PER:

This denotes if your policy limits coverage extends for the policy term, or per project/location you are working on. Most times the check mark is in the “Policy” field, but if you do have larger projects on a number of different locations, the company you are working for will sometimes require a “per project” policy as part of the insurance requirements.

C) POLICY NUMBER, POLICY EFF and POLICY EXP:

These represent your policy number, to use when referencing your policy with your broker or carrier.

Also listed here is your policy start date (eff date) and end date (policy exp). Each year you will receive a new certificate of insurance reflecting your current policy effective and end dates. The companies you work for will require to have a current certificate of insurance at all times.

D) LIMITS:

We will very much over simplify these limits to give you the core idea of what each represents.

EACH OCCURRENCE: This is how much the carrier will pay up to for each incident. Think of it as the limit for each claim.

DAMAGES TO RENTED PREMISES: (Ea. Occurrence) Accidental fire damage to premises you are renting.

MED EXP (Any one person): Covers you if you cause physical harm to a 3rd party, and protects you against lawsuits from someone if they get injured on your premises.

PERSONAL & ADV INJURY: Personal and advertising injury claims on your general liability policy include breach of privacy, advertising infringement, copyright, and defamation of character.

GENERAL AGGREGATE: This is how much the carrier will cover for all your claims over the policy period. For example if you have a $2,000,000 aggregate limit on your policy, you could have 3 separate claims of $500K, and your business would be covered. However if you had 3 claims of $800K per claim, you policy would only cover up to $2,000,000 and you would be responsible for the $400,00 over the $2,000,000 aggregate.

PRODUCTS -COMP/OP AGG: This covers damage caused by products that you sell to your clients. For example, your online shop sells muscle soreness alleviation creams. If your client has an allergic reaction from the cream they bought, you could have to pay their medical costs.

E) Description of Operations/Locations/Vehicles:

This acts as a comments section, to add in additional notes about the policies. Sometimes this could be adding someone as an additionally insured on a policy (which we cover here), or what endorsements are on the policies (which we cover here).

F) Certificate Holder:

This is where the name and address of the company that is requiring you to provide them with a copy of your certificate of insurance would go. When you have a company requiring them to be named on the certificate you will need to get your broker/agent to create a copy of your insurance for them. This is a common requirement of clients, partners, licensing bureaus, etc.

This provides a quick summary of how to interpret your Certificate of Insurance for your General Liability.

Let us know if you have any questions or need any help reading and understanding your Certificate!

Need help

understanding

your certificate?

No worries, we’re here to break it down for you!

Please note that the information on this website, including all articles, videos, and presentations, is expressly the opinion of the creator/author of that material. We are not lawyers and are not providing legal advice in regard to insurance. It is respectfully offered with the intention that exploring this material will be educational and helpful to you.